It seems that short term rental insurance is becoming increasingly complicated as time goes on.

A while ago, we posted an article on Airbnb Liability Insurance. A lot has changed since then including Airbnb now offering the $1,000,000 Host Protection, Peer’s Home Sharing Liability, and a few others.

In an effort to understand and navigate the market better, we decided that a question & answer session was the best approach to sort things out for you.

We sat down and spoke with our preferred insurance contact, Darren Pettyjohn, Co-Founder of Proper Insurance Services.

Proper is a Coverholder at Lloyd’s, which offers a comprehensive insurance product for short-term rentals.

And Darren is simply the most knowledgeable person we know in reference to short-term rental insurance…and he knows how to keep it easy-to-understand.

We are going to review topics such as:

- Tips for filing a short term rental insurance claim,

- What the Airbnb Host Protection does NOT cover,

- Why you need commercial liability insurance,

And much more.

Let’s get started!

Q – LearnAirbnb: Darren, what is the one thing you want our readers to learn about short term rental insurance in regard to their properties?

A – Darren: In the event, a guest is injured at your property, make certain you know what to do and be proactive. Many hosts have no clue what to do when something happens.

Q – LearnAirbnb: What do you mean by being proactive? And what do owners need to know?

A – Darren: Unfortunately, we live in a litigious society, and people will sue you for just about anything…especially when they are injured.

It happens every day. It happens at personal homes, grocery stores, and movie theaters…it’s everywhere.

And yes, it happens all too often at short-term vacation rentals.

The problem is when someone is injured at your property, you are naturally unprepared to be proactive as it’s typically something you have not been trained to deal with.

Instead of being proactive when they hear about an incident that occurred on their property, most hosts simply cringe, and say things like, “I’m so sorry, that’s terrible, is everyone OK?”.

These hosts do not think of their insurance company as an ally, but when it comes to injuries at your property, they are your BIGGEST ally. And they want you to call them…and call every time.

A majority of hosts think that filing a claim will count against them or that they will be penalized.

But this could not be further from the truth when it comes to liability claims! This is why there is usually NO DEDUCTIBLE with a liability claim. We WANT you to call us when you have an incident.

Q – LearnAirbnb: Okay, so short term rental hosts should call their insurance carriers immediately when an incident happens. What else do they need to do?

A – Darren: Here is what we teach our insured hosts to do when it’s discovered a renter/guest was injured at their property. There are 5 key steps to this process.

Step 1: Gather Statements

The first thing we tell all of our insured hosts to do is try and get a statement from the guest/renter/claimant of exactly what happened.

You can do this with an injury form. You can use this sample one here if you don’t have one already.

Even better than getting a written statement is to capture a recording/video on your cell phone of the guest explaining the incident.

It may feel weird asking for a statement, so tell the claimant its policy to document all injuries.

The key is to get THEM to report the ACTUAL circumstances of the accident.

If you get a statement like, “I was drinking too much, and fell down the stairs and broke my wrist, then I went to the hospital”, that’s great…they just admitted fault.

Step 2: Time, Place, and Photos

Next, you want to ask the claimant to show you or tell you exactly when and where the injury happened.

After you have gathered that information, you need to then immediately take multiple pictures/videos of the area in question.

The more photos and videos, the better. You only have a small window to collect visual evidence so DO NOT miss this step! (Darren will tell you why with an example later in this question and answer post.)

Step 3: Find Witnesses

After you have collected statements and other documentation from the guests, you should ask them if there were any witnesses.

If yes, get the name, phone number, and email of each witness. If they are present, then get a statement from them as well.

Again, explain its protocol to get their statement when an incident like this happens.

Lastly, ask anyone in the area if they saw what happened…a neighbor, other guests, anyone…and get a statement.

This may seem like overkill, but these statements may be able to save your short-term vacation rental business if a lawsuit comes your way!

Step 4: Keep Accurate Contact Information

There may be insurance claims where the injured party was NOT the person who booked your space, but rather an accompanying travel companion or daily visitor of the registered guest.

If that is the case, then make certain you have accurate contact information for the claimant, including name, phone, and email.

Step 5: Contact Your Short Term Rental Insurance Company

Immediately contact your insurance company to notify them someone was injured at your property. This is called making a claim, and it DOES NOT count ‘against’ you.

Most likely, the first thing the insurance company will do is ask you for all of the above documentation I asked you to get.

Next, they will contact the guest/claimant also to try and get a statement of theincident.

Airbnb Pro Tip: If you freak out and cannot get a statement, please call your short term rental insurance carrier IMMEDIATELY. Insurance adjusters are professionally trained to speak with claimants and are great at getting statements. Partner with them…they are here to help you out.

Q – LearnAirbnb: This seems pretty aggressive, don’t people typically just call their short term rental insurance company after they have been sued, or received a letter from an attorney?

A – Darren: You are correct…it is a bit aggressive, but we are trying to educate our insured hosts on how to be proactive as most are not aware of how liability claims work.

And if you call your insurance company AFTER you are sued or receive a letter from an attorney, then it may be too late for them to really help you out to the best of their ability.

Q – LearnAirbnb: What do you mean it could be too late?

A – Darren: This has to do with what we call statute of limitations.

If you do not know, the statute of limitations for injury is the time they have to sue you for damages when they are injured on your property. It varies from state to state.

For example, in Florida, a guest has four years from the date of the injury to make a claim against and/or sue you.

In New York, it is three years, and Maine it is six years! You can read a full list of Statute of limitations.

And a lot can be forgotten by you and the guest over those years! So that’s why you call your insurance company immediately.

Also, liability insurance is almost always per occurrence, not claims made.

I know that sounds complicated, but simply put it means that the insurance that will cover you as a short term rental host is the insurance that was IN PLACE when the occurrence HAPPENED…NOT when the actual claim was made.

Q – LearnAirbnb: So, Darren, you are saying, if someone was injured at a short-term Airbnb rental in Florida today, they could come back and sue the owner up to four years later for the injury that occurred today?

A – Darren: Correct. This is why we are trying extremely hard to educate owners on short term rental liability insurance.

Time is of the essence; when something happens, contact your insurance provider so they can go to work FOR you before it’s too late.

Get the insurance adjusters on the case.

Our third party adjusters are the best in the business…they don’t want to wait for the lawsuit.

They are hired by the insurance carrier to protect the carrier. Proper’s carrier happens to be Lloyd’s of London. And Lloyd’s invented the concept of insurance over 300 years ago. Shipping goods, Mayflower, gold, a coffee shop in London…here’s a link if you haven’t heard the story.

Q – LearnAirbnb: So, if I’m a short term rental host and I am not proactive and just let an incident go undocumented…what happens?

A – Darren: That’s an excellent question. Let’s look at two scenarios for the SAME liability insurance claim; reactive vs. proactive.

Scenario 1, Being Reactive:

John owns a vacation rental in New York and rents it to a family who has two young boys.

Upon checking out, the father informs John that one of his boys broke his arm after falling off the bunk bed.

The father also tells John that his two boys were roughhousing on the top bunk and the youngest fell off.

Lastly, he told John that after the injury, the family went to the hospital, the boy received a simple cast and was sent on his way.

John says to the guest, “Well, I guess it could have been worse, boys will be boys. I’m glad he is okay”.

Finally, the family checks out of John’s rental and goes home.

Meanwhile, John continues to short-term rent his property on Airbnb.

Now here’s where it gets crazy…

Sometime after the injured boy gets home, he begins experiencing back pain.

A few years go by, but the pain keeps getting worse and worse.

Finally, the father takes him to a back specialist, and it’s discovered he has a herniated disc which has also led to a compressed fracture in another disc. OUCH!

The doctor asked if the boy had been in any accidents over the past few years?

The father thinks back, and the only accident he can recall is the one in which his son fell off the bunk bed and broke his arm in that Airbnb his family rented…and they have medical records to prove it.

The doctor explains to the father that the two options for the boy are:

- Have intensive surgery when he’s fully mature, and his spine is done growing, or

- Just live with the pain and manage with medication.

The father consults a personal injury attorney and explains the injury and circumstances.

The attorney takes the case and accepts a contingency fee. That means no money upfront…only pay if we win. (You’ve seen the commercials…this sounds familiar, doesn’t it?)

The lawyer interviews the injured boy, and the boy can’t exactly recall the entire incident.

All he remembers is falling off the bunk.

BUT he does remember one detail though…the bunk was old, and the railing may have been loose and that’s why he fell.

Ironically enough, the boy had no recollection of roughhousing with his brother.

After gathering his information, the attorney files suit against John, the owner of the vacation rental, for negligence in having an old, faulty bunk bed in his rental…and ultimately for the bodily injury to the boy.

He also sues for punitive damages of $2,000,000. Yes, two MILLION dollars.

It’s now 2 ½ years after the incident and John gets served with legal papers.

Since the accident, though, he has sold the property.

So, John calls the insurance company who insured the rental at the time and files a liability claim.

Here’s where it gets tricky…

The insurance company sends an adjuster to the property in question and finds the bunk bed is no longer there.

The case goes to trial, the boy tells the same story he did to the lawyer, and a judgment is made against the host, John, for $1,000,000.

John’s insurance limit is $300,000, so the insurance provider pays $300,000, and the remaining $700,000 is on John to pay up.

John liquidates what assets he can and files for bankruptcy.

Trust me. As a short-term rental host, you DO NOT want to be John.

This is what happens when you are NOT proactive in gathering documentation when an incident occurs on your property.

Now, let’s look at the other scenario. The one we prefer…and you should too.

Scenario 2, Being Proactive:

The same incident occurs of the boy falling from the bunk bed after roughhousing with his brother, but after John hears of the boy’s injury, he has the father and son complete his injury form.

In the form, the father and son explain in detail how the injury happened.

An excerpt of what father writes includes: “Boys roughhousing on the bed and brother fell off”.

John then takes multiple pictures and a video of the bunk bed, clearly showing it’s in good working order.

John then notifies his insurance company and provides the details and documentation of the injury.

His insurance company also reached out to the injured boy’s family and got a statement of the incident as well.

2 ½ years after the incident, the same lawsuit is filed by the same lawyer helping the injured boy.

But there is a MUCH different outcome…

The case is dropped at the preliminary hearing as the fault is clearly on the claimant (guest), NOT the insured (host).

Here’s why:

- The injury form had explicit fault written and signed by the guest

- The insurance company had another statement of the incident

- The pictures showed the bunk bed was strong and in top working order

The insured host John, well he pays $0.00 in damages and $0.00 in legal costs because attorney’s fees are included in his liability insurance policy, and there is no deductible with a liability claim.

As a short-term rental owner, you would much rather experience scenario 2, where you do NOT have to pay a penny because you were proactive.

Q – LearnAirbnb: How common are liability insurance claims? The one you describe feels like an outlier example.

A – Darren: They are more common than you think.

We have seen claims involving many different scenarios, including invasion of privacy, slip and fall, and even assault.

However, the most common liability claim is involving the elderly.

Unfortunately, it’s very common for elderly people to break their hips as a result of osteoporosis. Basically, their hip breaks, and then they fall.

But health insurance companies often want to see it the other way around…they fell, and then their hip broke!

It’s the #1 bodily injury claim.

So again, be proactive: get a statement, take pictures, and call your insurance company.

These incidents happen all the time, and we knew that when we insured you. Let us go to work for you and help you out.

Q – LearnAirbnb: You keep saying call your insurance company, but what if your insurance company does not know you are short-term renting your property?

A – Darren: Great question.

I can’t stress enough to your hosts how important it is to call their insurance carrier and explain EXACTLY what they are doing with short-term renting.

Get clear answers in writing from your carrier, not just words over the phone. The liability exposure is simply too great to just take someone’s word for it.

And look…we are just talking liability claims. Your hosts need to think about property coverage as well.

We know of cases where major homeowner’s insurance carriers refused to handle a legitimate claim because the property was being used as a short term rental.

There are three types of liability insurance one can purchase for their property:

- Personal liability,

- Premise liability, and

- Commercial/business liability.

Both personal liability and premise liability carry a “business activity” exclusion, meaning if the claim is involved with a business transaction, there is no coverage, or the coverage could be denied.

Most would argue short-term renting is a business transaction. You receive payment in exchange for access to your space.

As the vacation rental industry continues to mature, more and more cities and counties are requiring owners of short-term rental properties to carry commercial/business liability.

Here is the Chicago short-term rental ordinance, see page 5, and Here is the Nashville short-term rental ordinance.

Again, these are two examples of hundreds happening. Take a look at the short-term rental regulation happening in California.

It really makes sense.

If Airbnb hosts are competing with Hilton Hotels, and Hilton is required to carry commercial insurance, why shouldn’t the host?

This maturation is ultimately going to lead to additional regulations as well. Regulations that require properties to be up to code with the Americans with Disability Act, fire and life safety regulations, and more.

Again, we believe that in the future…if it applies to Hilton, it will most likely apply to the Airbnb Host’s property which serves a purpose no different than a hotel.

Q – LearnAirbnb: So, you are saying, no matter what, if someone short-term rents a property they NEED to carry commercial or business general liability?

A – Darren: Correct. But hosts get confused about this.

The confusion comes because they call their agent and often get an answer like…“I wouldn’t worry about it as hosting is an occasional thing”, or “if the carrier doesn’t know about it, I wouldn’t worry about it.”

The grey area comes with the word “occasional”.

Most carriers of personal liability allow for the “occasional” rental of your property but do not clearly define the word occasional.

The definition of occasional is occurring, appearing, or done infrequently.

Most owners of properties who host on Airbnb would not be considered “occasionally” renting.

In fact, most properties on Airbnb are non-owner occupied properties that advertise the entire property for rent. They are really considered vacation rentals.

In our opinion, if you are actively renting your property on sites such as Airbnb, then you are beyond the scope of “occasional” renting.

If you want to know if your CURRENT insurance is enough to keep you covered, here are two simple questions an owner needs to ask their agent, or supplemental carrier:

Question 1: If I regularly rent my property to guests for periods of less than 30 days at a time, and one of those guests is injured at my property and claims me liable for their injuries, will my liability insurance respond?

Very Important Note: If you get a “yes” from the carrier, make sure to follow up and ask for a detailed list of exactly what is excluded.

Red Flag Exclusions would be assault and battery, sexual abuse or molestation, animals, liquor, punitive damages, Americans with Disability Act violations, fire or life safety violations, bed bugs, and personal or advertising injury.

Question 2: If I regularly rent my property to guests for periods of less than 30 days at a time, and one of those guests burns my property down, resulting in a total loss, will you rebuild my house?

Virtually ALL property insurance covers fire, so if you get any grey answers on this question, then just assume you are NOT covered.

Those two cover the common exposures, but other questions to ask your insurance carrier in regard to property insurance would include business income, vandalism, theft, water damage, etc.

Just make sure all the questions are in relation to a GUEST causing the incident.

Q – LearnAirbnb: You have mentioned supplemental coverage a few times, can you explain that in more detail?

A – Darren: In insurance, we use the term supplemental coverage as something that would not stand alone, or sometimes “in addition to”, or “not comprehensive”.

Here’s a common example.

A property owner might carry a homeowner’s policy and have a supplemental flood insurance policy.Or, for this topic, a short term rental host may a homeowner’s policy and supplemental liability policy.

So supplemental insurance would not replace a comprehensive homeowners or landlord policy, it would be used in addition to it.

Another example many hosts have heard about would be the Airbnb Host Protection, which is the $1,000,000 in commercial general liability that covers every booking on Airbnb.

There are more insurance providers in the market now as supplemental commercial liability for short-term rentals has risen in popularity the last year or so.

It’s a major gap in homeowners and landlord policies, so it makes sense for supplemental products to be developed.

As I’ve explained before, carriers (and insurance in general) is slow to adapt to emerging or unusual markets, point in case, a market like Airbnb or short-term rentals.

Q – LearnAirbnb: Darren, are you OK with talking more and explaining the Airbnb Host Protection?

A- Darren: Do you have another 30 minutes Jim? I figured you would ask, and I’m glad you did!

All I can speak on is what I can research and what we hear from our Airbnb Hosts.

In a sense, insurance is a simple thing, because it’s very black and white. Something is either covered or not covered.

An insurance policy is a contract, and in that contract or policy, it will clearly outline what’s covered and what’s not covered.

An insured party will pay a premium for the contract, and in return, an insurer will agree to pay claims.

Pretty simple, right?

One problem…the Host Protection is FREE, and to my knowledge, no consumer has ever seen a copy of the contract or policy!

Let me be clear here, I love Airbnb just like you Jim, and we insure thousands of Airbnb Hosts, but free insurance for everyone?

The first thing that comes to mind…what’s the catch?

So, let’s examine what we do know. I will be reviewing the Airbnb Host Protection Insurance Summary , which is provided by Airbnb.

I have searched in-depth and still have not found any documentation or reviews that a liability claim has EVER been paid or defended.

What I have found are multiple websites, forums, and reviews of denials and complaints in reference to both the Airbnb Insurance and their response representatives.

We can’t examine the policy, but from the summary, here is the clear statement on the first page:

This statement seems too general as most, or all, carriers start with the commercial forms, but exclusions vary significantly between carriers.

Essentially, exclusions weaken or lessen coverage.

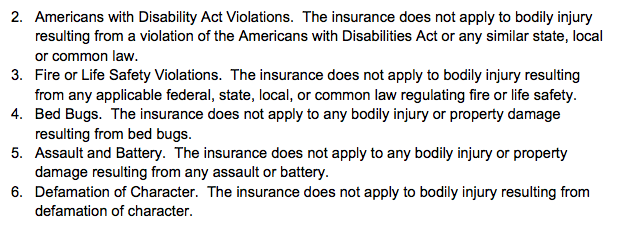

The Airbnb Host Protection summary does list a summary of key exclusions.

Let’s focus on those to see if they are truly ‘in line’ with commercial policies.

It’s obvious to see that these listed exclusions are not ‘in line’ with commercial general liability which, if you really want to dig deep, you can look at it here.

The three exclusions of the Airbnb Host Protection that immediately jump out are “assault and battery”, “sexual abuse” and “personal and advertising injury”.

What this means that if an Airbnb guest is mugged on the steps of the rental and they sue the owner, the Host Protection will NOT pay or respond, based on the “assault and battery” exclusion.

Mugging is one of the main reasons insurance carriers exclude assault. The guest could argue they were not informed of crime in the area. I know this may seem farfetched to some, by why would they exclude it then?

Or worse, what if a young girl was sexually assaulted while staying at an Airbnb vacation rental property.

And years later, she comes out, and the owner of the rental is sued because they did not notify the guest’s that a pedophile or registered sex offender lived in the area?

The Airbnb Host Protection Insurance will NOT pay or respond to that either.

Remember the statute of limitations scenario involving the boy who fell off the bunk bed we covered earlier? The same rules apply for sexual assault, or molestation, as victims often wait to come out.

You DO NOT want an assault or sexual abuse exclusion.

Very Important Note: Insurance carriers do not exclude things like assault and sexual abuse because it’s standard practice, rather carriers add these exclusions because they don’t want to pay out claims for these huge exposures.

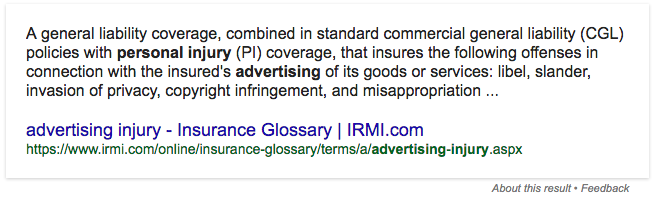

The Personal and Advertising Injury is just flat NOT covered by Airbnb Host Protection.

Person and Advertising Injury is defined as…

Most Airbnb hosts don’t know of this coverage, and that it includes “invasion of privacy”.

We have seen this claim often as it’s easy for a guest to claim this on virtually any rental. This is an Internet-centric business, right?

Most of the time it’s thrown out of court, or a small settlement is paid, but again, you need legal defense covered…and lawyers aren’t cheap.

Also, if you read the above definition of Personal and Advertising Injury, it clearly says, personal and advertising injury is in standard commercial general liability.

This is another small example of how the Host Protection is not “in line” with the standard form.

So, to wrap that up…it’s clear the Airbnb Host Protection is not “in line” with standard commercial general liability.

To make a full determination of its coverage, we simply need to see the policy and ALL the language in it, not just a summary. I imagine there are dozens more exclusions and limitations.

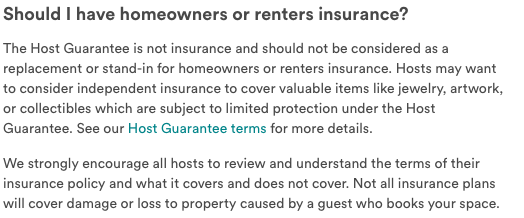

Q – LearnAirbnb: Wow, those are some big holes in the Airbnb Host Protection Insurance. What about the Airbnb Host Guarantee?

A – Darren: I’m glad you asked! Another concern is the way Airbnb has handled the Host Guarantee, which is the $1,000,000 in free property damage coverage.

So, say a guest burns your house down, and you shoot Airbnb an email…“Hey, a guest burned my house to the ground, please come fix and rebuild it!”

Do you think they are rebuilding your home the next day with the help of Habitat for Humanity!? Probably not.

The Host Guarantee Terms are clearly laid out for everyone to read…why is the Host Protection Insurance not the same?

And as far as Airbnb rebuilding your home, I would not count on it.

I have read and heard more about loopholes for denying even minor claims in regard to the Host Guarantee.

I’ve read statements like, “The claim was submitted incorrectly, or Airbnb could not get a hold of the guest within 14 days, or it’s denied for this, or that simple reason”.

It’s truly amazing and outrageous, but pure genius marketing on their part. Not to mention it clearly states it’s not insurance:

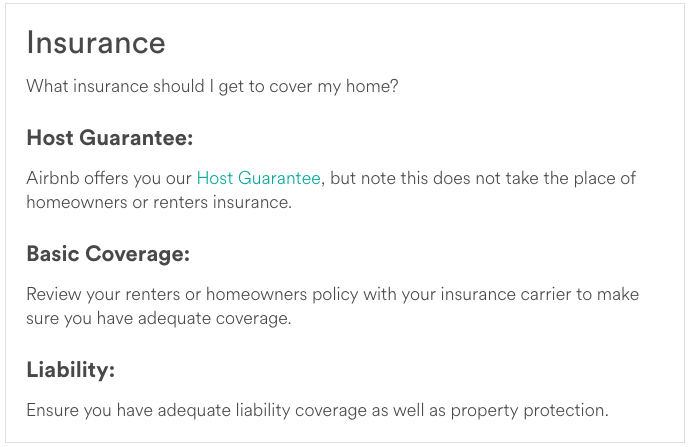

The most peculiar thing about the Host Protection and the Host Guarantee is that after all the effort and all the marketing, when you go to Responsible Hosting on the site, here is what you get:

Airbnb States: Review your policy with your insurance carrier and ensure you have adequate liability coverage. Pretty thin…and to think, all they had to do was have a link to Proper Insurance to help provide short term rental insurance to their hosts.

Q – LearnAirbnb: You mentioned some other supplemental carriers for commercial liability. Since most hosts do not want to rely solely on the Host Guarantee, what other options do they have?

There is a trend happening that I like to call “The Travel Insurance Effect on Commercial General Liability”.

Most people are familiar with travel insurance. You have booked a flight or rental on Expedia or Orbitz, and at the end of your booking it always asks, “do you want to insure your trip for $69”, or something similar.

This offered insurance would cover your airline tickets if you got sick, lost baggage, and even includes $1,000 in accidental damage if you damage a hotel or rental.

Simply check the box, click the button, agree to the terms, and you’re covered.

How easy was that?! Very easy because it’s a measured risk.

The insurer knows exactly what the risk is, has 20+ years of actuaries, and the traveler just wasted $69!

But commercial general liability is an entirely different animal.

The coverage is so broad, and short-term rental liability exposure is so unknown.

So, what do the carriers do? Exclude, exclude, exclude.

And these exclusions vary widely from carrier to carrier.

At Proper Insurance, we look at every single risk or property we insure.

We ask: Is there a swimming pool, is there a trampoline, is there playground equipment, is there food, is there a zip line into a lake, are there bicycles, canoes, and so forth.

We understand that each property is unique and that there is an art to underwriting. We are not going to hand out $1,000,000 in commercial general liability to anyone who simply agrees to click a button.

Sometimes people forget an insurance carrier needs to collect more premium than it pays out in claims. So, how do carriers limit the claims they pay out on? Exclusions.

Yes, there are some carriers going down the supplemental road, and some are even partnering with property managers to have their easy “click-to-add-button” at the end of a vacation rental booking…and worse, passing the $8-$10 per night fee onto the owner or guest.

Very Important Note: If the supplemental liability carrier advertises “Easy Online Claims”, turn and run, as hopefully by now you understand a liability claim is not an “easy online process”, nor should it be.

Two that have risen quickly are Comet Insurance and Peers Home Sharing.

They have the identical exclusions so one must assume they are both underwritten by the same carrier, USLI.

Since Peers published the policy on their site, we actually get to read the contract and see where there might be some concerns.

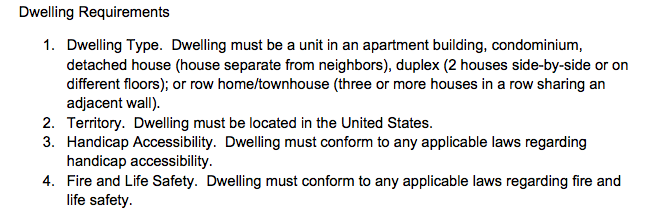

Let’s look at the dwelling requirements of the Peers policy first:

If I’m reading this correctly, these dwelling requirements might be an issue for some owners.

As a consumer, this would be a HUGE red flag for me. There are reasons insurance carriers add requirements and exclusions to policies, but why these ones specifically?

In regard to requirement #3, I have to imagine 9 out of 10 Airbnb properties, and short-term vacation rentals are not handicap accessible.

Because this is commercial insurance, I assume commercial rules apply. If you can’t meet those requirements, then this policy would likely not protect you.

Now with requirement #4, I do not know the fire and life safety laws in every state, but I assume they are very robust.

Just thinking about fire extinguishers and multiple means of exit and egress in the event of a fire would overwhelm many hosts.

For example, some local fire codes may require that if you were hosting guests on the second floor of your home, then you would need the stairs, and then a throw-rope ladder for the window…ultimately giving two means of exit in the event of a fire.

Now seriously, I can’t imagine someone trying to navigate through the National Fire Protection Association regulations.

Next, let take a look at the actual exclusion language on the Peers policy:

I would like to make a quick comparison between this policy and the commercial general liability included in the Proper policy.

ADA Violations: NOT Excluded with Proper Insurance

Fire or Life Safety Violations: Not Excluded with Proper

Bed Bugs: Not Excluded with Proper

Assault and Battery: Not Excluded with Proper

Defamation of Character: Not Excluded with Proper

I hope your readers can see now that exclusions are the KEY to understanding insurance…especially when it comes to commercial general liability coverage.

Not only does Proper not exclude any of the above, but Proper actually removes and alters some of the standard exclusions which you can find further down in the commercial form linked to earlier.

For example, all commercial liability excludes liquor liability. We don’t. Proper actually removes the liquor liability exclusion.

This means that if a short term rental owner wanted to provide a complimentary mini-bar to their guests, they would have coverage through Proper.

Our coverage versus everyone else…there is no comparison.

Q – LearnAirbnb: We have covered a lot in this Q & A; would you please summarize a quick rule of three for our audience?

A – Darren: Yes, I’m a firm believer in the rule of three. Keep it simple.

Rule #1: If you own a short-term rental property, or lease a property for re-renting on Airbnb, you most likely already carry some type of insurance for the property. Either a homeowner, landlords, condo, or renter’s policy.

Do NOT keep it in place and simply rely on some random type of supplemental policy. As you can see, supplemental liability coverage is not enough and may be limited in scope.

Contact your carrier immediately to see if you’re covered. Ask the two questions we covered earlier and get it in writing.

Rule #2: You are already paying a premium for your current policy, so cancel it, and find a comprehensive policy that can replace it.

If you combine the cost of your current policy and the supplemental policy, it’s likely a wash in cost.

If you trust your agent, get clear answers in writing and be 100% certain you are purchasing a policy that carries commercial general liability. You do not want personal or premise liability.

Rule #3: Understand what you are purchasing and feel good about paying the premium.

We all know the success stories in short-term renting, but don’t go underinsured as it’s too big of a risk. Crazy things happen.

Take the time to shop and find a comprehensive policy.

The most important thing is to buy a commercial general liability policy from a reputable broker such as Proper Insurance.

Short Term Rental Insurance FAQ

For a more summarized review of the information above as well as the answers to some of the more commonly asked questions, refer to the FAQ below.

Does homeowner’s insurance cover Airbnb hosting?

Regular home-sharing is considered a business activity. Therefore, in some cases, insurance companies do offer protection for Airbnb hosts who have tenants that only stay occasionally. A standard home insurance policy provides liability coverage and property damage, that may extend to guests of the property as well as their belongings.

Do you need to have commercial insurance for an Airbnb?

Since home-sharing is considered a business activity, you need to have coverage that includes a home-sharing endorsement, or you need to have a separate commercial insurance policy. Sometimes, you can find an Airbnb insurance endorsement available through your current insurance company. This coverage should apply to theft and property damage.

Who needs home-sharing insurance if renting through Airbnb or other home-sharing sites?

If you are a host who is looking to home-sharing, then you need to talk to your insurance company and let them know what you are doing. They may suggest a landlord policy that may cover the structure, the appliances and furnishings, and lost rental income due to damage, legal fees, and liability claims.

Does Airbnb have protection for guests?

Under the Host Protection Insurance program, the host is provided with primary liability coverage for up to $1,000,000 per occurrence if there is a third-party claim of any bodily injury or property damage that was related to their stay in the Airbnb rental. For example, if a guest trips on a rug in the Airbnb rental and they become injured, they can file a claim for the injury against the Airbnb host.

✔ How to avoid the BIG mistakes that most hosts make

✔ The secret weapon of all Top 1% Hosts

✔ The pricing strategy used by professionals

✔ How to consistently get gleaming 5-Star reviews

✔ How to free up your time without becoming a "robotic host"

This free training is brought to you by James Svetec an Airbnb Expert who has managed over $1M in bookings & Symon He, the founder of LearnBNB, the #1 Airbnb hosting education blog.

Learn about all of the secrets that professional hosts don't want you to know

Proper should be more forthcoming that they do not offer Insurance for “roomsharing” (room by room) houses.